Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| Oxford Industries, Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

NOTICE OF 2017 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JUNE 17, 201514, 2017

Notice is hereby given that the 2015 annual meeting2017 Annual Meeting of shareholdersShareholders of Oxford Industries, Inc. will be held on Wednesday, June 17, 201514, 2017 at 3:2:00 p.m., local time, at The Fifth Floor Conference Center at 999 Peachtree Street, N.E., Atlanta, Georgia 30309. The purposes of the meeting are to:

Shareholders of record as of the close of business on April 17, 201513, 2017 will be entitled to notice of and to vote at the annual meeting or at any adjournment or postponement of the annual meeting. This notice

We have elected to provide access to our proxy materials over the Internet under the U.S. Securities and the accompanying proxy statement areExchange Commission's "notice and access" rules. A Notice of Internet Availability of Proxy Materials is being mailed to shareholders beginning on or about May 15, 2015.3, 2017. This 2017 proxy statement and our 2016 Annual Report on Form 10-K may be accessed by all shareholders athttp://www.edocumentview.com/oxford. Any shareholder may request a printed copy of the proxy materials by following the instructions set forth in the Notice of Internet Availability.

A list of our shareholders entitled to vote at the annual meeting will be available for examination by any shareholder, or his or her agent or attorney, at the annual meeting. The enclosed proxy is solicited on behalf of our Board. Reference is made to the accompanying proxy statement for further information with respect to the items of business to be transacted at the annual meeting.

Your vote is important. Regardless of whether you plan to attend the annual meeting, you are encouraged to vote as soon as possible. You may vote over the Internet, byyou may vote in person at the annual meeting or, if you request a paper copy of the proxy materials, you may vote via a toll-free telephone number or by signing, dating and returning the enclosedmailing a completed proxy card. Please review the instructions on each of your voting options described onin the enclosed proxy card. You may revoke your proxy at any time before the meeting and, if you attend the meeting, you may elect to vote in person.Notice of Internet Availability. If your shares are held in an account at a bank or broker, your bank or broker will vote your shares for you if you provide voting instructions. In the absence of instructions, your broker can only vote your shares on limited matters.

Attendance at the annual meeting is limited to shareholders, those holding proxies from shareholders, and invited guests such as members of the media. If your shares are held in an account at a bank or broker, you should bring the notice or voting instruction form you received from your bank or broker, or obtain a valid proxy card from your bank or broker, in order to gain admission to the meeting.

| May | By Order of the Board of Directors, | |

| Thomas E. Campbell Executive Vice President—Law and Administration, General Counsel and Secretary |

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on June 17, 2015:14, 2017: This proxy statement and our fiscal 20152016 annual report to shareholderson Form 10-K are available on the Internet at http://www.proxymaterials.oxfordinc.com.www.edocumentview.com/oxford.

PROXY STATEMENT | 1 | |

INTRODUCTION | 1 | |

INFORMATION ABOUT THE MEETING AND VOTING | 1 | |

Shares Outstanding | 1 | |

Voting | 1 | |

Broker Discretionary Voting; Broker Non-Votes | 2 | |

Changing Your Vote | 2 | |

Quorum | 2 | |

CORPORATE GOVERNANCE AND BOARD MATTERS | ||

Directors | ||

Director Independence | ||

Corporate Governance Guidelines; Conduct Policies | ||

Board Meetings and Committees of our Board of Directors | ||

Meetings of Non-Employee Directors | ||

Board Leadership | ||

Board's Role in Risk Oversight | ||

Website Information | ||

Director Nomination Process | ||

Director Compensation | ||

EXECUTIVE OFFICERS | ||

EXECUTIVE COMPENSATION | ||

Introduction | ||

Compensation Discussion and Analysis | ||

Compensation Tables | ||

Potential Payments on Termination or Change of Control | ||

NOMINATING, COMPENSATION & GOVERNANCE COMMITTEE REPORT | ||

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | ||

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | ||

AUDIT-RELATED MATTERS | ||

Report of the Audit Committee | ||

Fees Paid to Independent Registered Public Accounting Firm | ||

Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors | ||

COMMON STOCK OWNERSHIP BY MANAGEMENT AND CERTAIN BENEFICIAL OWNERS | ||

Management | 31 | |

Certain Beneficial Owners | 32 | |

Section 16(a) Beneficial Ownership Reporting Compliance | ||

EQUITY COMPENSATION PLAN INFORMATION | ||

PROPOSALS FOR SHAREHOLDER CONSIDERATION | ||

Proposal No. 1: Election of Directors | ||

Proposal No. 2: Approval of Selection of Independent Registered Public Accounting Firm | ||

Proposal No. 3: Advisory Vote to Approve Executive Compensation | ||

| ||

ADDITIONAL INFORMATION | ||

Annual Report on Form 10-K | ||

Submission of Director Candidates by Shareholders | ||

Shareholder Proposals | ||

Communications to our Board of Directors | ||

Proxy Solicitation |

999 Peachtree Street, N.E., Suite 688

Atlanta, Georgia 30309

For 2017 Annual Meeting of Shareholders Meeting

To Be Held on June 17, 201514, 2017

This proxy statement contains information relating to the annual meeting2017 Annual Meeting of shareholdersShareholders of Oxford Industries, Inc. to be held on Wednesday, June 17, 2015,14, 2017, beginning at 3:2:00 p.m., local time. The annual meeting will be held at The Fifth Floor Conference Center at 999 Peachtree Street, N.E., Atlanta, Georgia 30309. You may contact our Investor Relations Department at (404) 659-2424 to obtain directions to the site of the annual meeting.

We have elected to provide access to our proxy materials over the Internet. Accordingly, we are mailing a Notice of Internet Availability of Proxy Materials to our shareholders instead of a paper copy of our proxy materials. We believe that providing our proxy materials over the Internet increases our shareholders' ability to access the information they need while reducing the environmental impact of our annual meeting. The Notice of Internet Availability contains instructions for accessing our proxy materials and submitting a proxy over the Internet. The Notice of Internet Availability also contains instructions for requesting a paper copy of our proxy materials. We will begin mailing this proxy statement, the attached Notice of Annual Meeting of Shareholders and the accompanying proxy cardInternet Availability on or about May 15, 20153, 2017 to all holders of our common stock, par value $1.00 per share, entitled to vote at the annual meeting. Along with thisA similar notice will be sent by brokers, banks and other nominees to beneficial owners of shares of which they are the shareholder of record.

This 2017 proxy statement we are also sendingand our 2016 Annual Report on Form 10-K are available athttp://www.edocumentview.com/oxford. We will mail any shareholder a copy of the proxy materials free of charge upon request, but you will not receive a printed copy of the proxy materials unless you request one. You may request to Shareholders for fiscal 2014, which ended on January 31, 2015.receive a copy of proxy materials by following the instructions set forth in the Notice of Internet Availability.

INFORMATION ABOUT THE MEETING AND VOTING

You may vote at our 20152017 annual shareholders meeting if you owned shares of our common stock as of the close of business on April 17, 2015,13, 2017, the record date for the annual meeting. As of the record date,April 13, 2017, there were 16,575,21516,860,913 shares of our common stock issued and outstanding. You are entitled to one vote for each share of our common stock that you owned on the record date.

If on April 17, 2015, your shares of Oxford common stock wereare registered directly in your name with Computershare, our transfer agent, then you are a shareholder of record. As a shareholder of record, you may vote using one of the following methods:

If you are a shareholder of record and you sign and return your proxy card but do not include voting instructions, your proxy will be voted as recommended by our Board or, if no recommendation is given, in the discretion of the proxies designated on the proxy card, to the extent permitted under applicable law.

If you are a shareholder of record, your shares will not be voted unless you submit a proxy or attend the annual meeting and vote in person. If you vote over the Internet, or by telephone, please have your proxy cardNotice of Internet Availability available at the time you submit your voting instructions. The Internet and telephone voting procedures provided on the enclosed proxy card are designed to authenticate shareholders' identities and to confirm that their instructions have been properly recorded.

If, on April 17, 2015,like most of our shareholders, your shares wereof Oxford common stock are held in an account at a bank or broker, like most of our shareholders, then you are the beneficial owner of shares held in "street name" and these proxy materials are being forwarded to you by that

organization. The bank or broker holding your account is considered the shareholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right tomay direct your bank or broker on how to vote the shares in your account. Telephone and/or Internet voting may also be available to direct your bank or broker on how to vote the shares in your account, but the availability of telephone and/or Internet voting will depend on the voting processes of your bank or broker. Please follow the directions on your proxy card or voting instruction form carefully. Even if your shares are held in an account at a bank or broker, you are invited to attend the annual meeting. However, since you are not the shareholder of record, you may not vote your shares in person at the meeting unless you obtain a valid proxy card from your bank or broker and, in order to gain admission to the meeting, you should bring the notice or voting instruction form you received from your bank or broker or obtain a valid proxy card from your bank or broker.

Broker Discretionary Voting; Broker Non-Votes

If you hold shares through an account with a bank or broker, your shares may be voted by the bank or broker even if you do not provide voting instructions. Banks and brokerage firms have the authority, under the rules of the New York Stock Exchange (the(which we refer to as the "NYSE"), to vote shares in their discretion on certain "routine" matters when their customers do not provide voting instructions. Under the NYSE's rules, as currently in effect, only Proposal No. 2 (approval of the selection of Ernst & Young LLP as our independent registered public accounting firm for fiscal 2015)2017) is considered a routine matter.

The other proposals to be addressed at the annual meeting are considered "non-routine" matters under the NYSE's rules. When a bank or brokerage firm has not received voting instructions from the beneficial holder of the shares with respect to a non-routine matter, the bank or brokerage firm cannot vote the shares on that proposal. This is called a "broker non-vote." Broker non-votes will be counted as present at the annual meeting for quorum purposes but will not be counted as entitled to vote on the non-routine matter.Therefore, if your shares are held in an account at a bank or broker, it is important that you provide voting instructions to your bank or broker so that your vote on these proposals is counted.

If you are a shareholder of record, you may revoke or change your vote with respect to the shares of our common stock that are registered directly in your name by doing any of the following:

If your shares are held in an account at a bank or broker, then you must follow the instructions provided by your bank or broker in order to revoke or change your vote with respect to those shares held in street name.

In order for us to conduct the annual meeting, the holders of a majority of the shares of our common stock issued and outstanding as of the record date must be present, in person or by proxy, at the annual meeting. This is referred to as a quorum. Abstentions and broker non-votes, if any, will be counted as shares present at the meeting for purposes of determining the presence of a quorum.

CORPORATE GOVERNANCE AND BOARD MATTERS

Under our articles of incorporation, or charter, our Board is to consist of at least nine members, with the specific number fixed by our bylaws, as amended from time to time. Currently,There are currently 10 members serving on our bylaws have fixedBoard.

Our charter provides that the number of directors at 11.

J. Hicks Lanier, onemembers of our Board are to be divided into three classes. Our Board currently consists of three Class I directors (Messrs. J. Reese Lanier, Dennis M. Love and our current Chairman,Clyde C. Tuggle), three Class II directors (Messrs. Thomas C. Chubb III, John R. Holder and Clarence H. Smith) and four Class III directors (Ms. Helen Ballard, Mr. Thomas C. Gallagher, Ms. Virginia A. Hepner and Mr. E. Jenner Wood III).

The term for Mr. J. Reese Lanier, who has reached the mandatory retirement age under our bylaws and, accordingly, is retiring fromserved on our Board since 1974, expires at the conclusion of the annual meeting. Because Mr. Lanier has served asreached the Chairmanretirement age of 72 prior to the beginning of our Board since 1981, and also servedcurrent fiscal year, he is no longer eligible for election as a director under our Chief Executive Officer from 1981 until his retirementbylaws. Therefore, Mr. Lanier will not seek re-election as a director at the end of

2012. Mr. Lanier has provided strong leadership to our company as we transformed from our historical domestic manufacturing roots into an international apparel design, sourcing and marketing company with a portfolio of owned and licensed lifestyle brands and company-owned retail operations.annual meeting. We thank Mr. Lanier for his many years of service to our company.

Following Mr. Lanier's retirement, thereOur charter provides that successors to the class of directors whose terms expire at an annual meeting are to be elected for three year terms; however, our charter also contemplates that the number of directors in each class will be as nearly equal in number as possible. In order to rebalance our Board, our Board has nominated Mr. E. Jenner Wood III, who is our lead director and was most recently re-elected as a vacancy onClass III director at our Board.2016 annual meeting, to stand for election as a Class I director nominee at this annual meeting and to vacate his position as a Class III director. Our Board may choose to immediately fillexpects that, following the vacancy, allow the vacancy to remain open until a suitable candidate is located and elected, orannual meeting, it will amend our bylaws to reducefix the number of directors serving on our Board.at nine members effective immediately following the meeting.

Our Board has nominated the following current directorsIn addition to nominating Mr. E. Jenner Wood III to stand for re-electionelection at the annual meeting: Thomasmeeting, our Board has also nominated Mr. Dennis M. Love and Mr. Clyde C. Chubb III; John R. Holder; and Clarence H. Smith.Tuggle for election as Class I directors at the annual meeting.

The following table sets forth, as of April 17, 2015,13, 2017, certain information concerning our nominees for director and our continuing directors, as well as a description of the specific experience, qualifications, attributes and skills that led our Board to conclude that each of these individuals should serve as a director.

Name | Age | Director Since | Positions Held and Specific Experience and Qualifications | ||||

|---|---|---|---|---|---|---|---|

| Thomas C. Chubb III | | 51 | 2012 | Mr. Chubb is our Chief Executive Officer and President. He has held that position since 2013. Mr. Chubb served as our President starting in 2009, as our Executive Vice President from 2004 until 2009, and as our Vice President, General Counsel and Secretary from 1999 to 2004. Mr. Chubb has been employed by our company for 25 years, and has been an executive with our company for more than 15 years. In his capacity as our President starting in 2009, Mr. Chubb provided direct oversight with respect to the operations of our Ben Sherman Group and our Lanier Clothes Group and, starting with our acquisition of those operations in 2010, provided direct oversight with respect to the operations of our Lilly Pulitzer Group. In addition, Mr. Chubb's previous experience as our General Counsel gives him key insights into the business, legal and regulatory environment in which we operate. Mr. Chubb's long history with our organization, his leadership skills and his knowledge of our businesses and industry serve our Board well. | |||

Thomas C. Gallagher | 67 | 2013 (previous service 1991 - 2007) | Mr. Gallagher is Chairman and Chief Executive Officer of Genuine Parts Company, a distributor of automotive replacement parts, industrial replacement parts, office products and electrical/electronic materials. He was appointed Chief Executive Officer of Genuine Parts Company in 2004 and Chairman of the Board of Genuine Parts Company in 2005. Mr. Gallagher served as President of Genuine Parts Company from 1990 to 2012 and Chief Operating Officer of Genuine Parts Company from 1990 until 2004. Mr. Gallagher has approximately 25 years of executive-level responsibilities with a NYSE-traded public company; brings extensive experience serving on the boards of directors of other companies, including having served on the board of directors of Genuine Parts Company for more than 20 years and having previously served on the boards of directors of STI Classic Funds, STI Classic Variable Trust and National Services Industries, Inc.; and is extremely familiar with our company, having previously served on our Board for more than 15 years, including at the outset of our transformation away from our historical domestic private label manufacturing roots. Mr. Gallagher's business acumen, financial expertise and leadership skills are a valuable asset to our Board and Audit Committee. | ||||

Name | Age | Director Since | Positions Held and Specific Experience and Qualifications | ||||

|---|---|---|---|---|---|---|---|

| Helen Ballard | | 62 | 1998 | Ms. Ballard is the owner of Helen Ballard LLC, a company she formed in 2015 in the business of home furnishing product design. Prior to forming Helen Ballard LLC, Ms. Ballard founded Ballard Designs, Inc. in 1983 and served as its Chief Executive Officer until she retired from that position in 2002. Ballard Designs, Inc. is a home furnishing catalog and brick-and-mortar retail business which is currently part of HSN, Inc. Ms. Ballard has more than 20 years of experience in a chief executive capacity. Ms. Ballard also previously served as a member of the Board of Directors of Cornerstone Brands, Inc., which was organized as a conglomerate of companies selling home and leisure goods and casual apparel through catalogs primarily aimed at affluent, well-educated consumers ages 35 to 60. Ms. Ballard's experience in direct-to-consumer businesses, in particular with business activities aimed at demographics overlapping those of our various operating groups, serves our Board well. | |||

Name | Age | Director Since | Positions Held and Specific Experience and Qualifications | ||||

|---|---|---|---|---|---|---|---|

| George C. Guynn | | 72 | 2007 | Mr. Guynn retired in 2006 from his position as President and CEO of the Federal Reserve Bank of Atlanta, where he worked his entire career. Mr. Guynn currently serves as a director of Acuity Brands, Inc. and served as a director of Genuine Parts Company until his retirement from that board as of its April 2015 annual meeting. Mr. Guynn serves on the Audit and Governance Committees of Acuity Brands, Inc. He is also a trustee of Ridgeworth Investments. Mr. Guynn's prior role as President and CEO of the Federal Reserve Bank of Atlanta, and the keen insight this experience has provided him into economic trends affecting the U.S. and global economies, provides our Board with information and insight in financial and regulatory issues. In addition, Mr. Guynn's financial and accounting experience with the Federal Reserve, as well as his experience as a member of the audit committee of Acuity Brands, Inc., and previously as a member of the audit committee of Genuine Parts Company, offer a high level of financial literacy and is a valuable asset to our Board and Audit Committee. | |||

John R. Holder | 60 | 2009 | Mr. Holder is Chairman and Chief Executive Officer of Holder Properties, a commercial and residential real estate development, leasing and management company, and has held that position since 1989. Mr. Holder has served as Chief Executive Officer of Holder Properties since 1980. He is a member of the Board of Directors and Compensation, Nominating and Governance Committee of Genuine Parts Company and also serves on the Board of Directors of SunTrust Bank's Atlanta Region. Mr. Holder's strategic leadership in the growth of Holder Properties, which has been involved in over 10 million square feet of real estate development totaling in excess of $1.5 billion, as well as his extensive involvement in the financial and marketing areas of that business, serves our Board well. His service as the Chairman and Chief Executive Officer of Holder Properties, together with various board affiliations which has included civic organizations and membership on the Audit and Compensation, Nominating and Governance Committees of Genuine Parts Company, has given him leadership experience, business acumen and financial literacy beneficial to our Board and Audit Committee. | ||||

J. Reese Lanier* | | 72 | 1974 | Mr. Lanier was self-employed in farming and related businesses and had this occupation for more than five years until his retirement in 2009. Mr. Lanier has been affiliated with our company in various official and unofficial capacities for more than 50 years, including having served as a director for more than 40 years. His father was one of the founders of our company. Mr. Lanier's deep knowledge of our business and industry, coupled with his business acumen as a sole proprietor, serves our Board well. | |||

Name | Age | Director Since | Positions Held and Specific Experience and Qualifications | ||||

|---|---|---|---|---|---|---|---|

Thomas C. Chubb III | 53 | 2012 | Mr. Chubb is our Chairman, Chief Executive Officer and President. He has served as Chief Executive Officer and President since 2013 and was also elected our Chairman in 2015. Mr. Chubb served as our President starting in 2009, as our Executive Vice President from 2004 until 2009, and as our Vice President, General Counsel and Secretary from 1999 to 2004. Mr. Chubb has been employed by our company for approximately 30 years, and has been an executive with our company for more than 15 years. Mr. Chubb has provided direct oversight for many of our operating groups for several years and has been instrumental in our transformation from our historical domestic private label manufacturing roots to becoming a global company engaged in the design, sourcing, marketing and distribution of lifestyle branded apparel products. Mr. Chubb's previous experience as our General Counsel also gives him key insights into the business, legal and regulatory environment in which we operate. Mr. Chubb's long history with our organization, his leadership skills and his knowledge of our businesses and industry serve our Board well. | ||||

Thomas C. Gallagher | | 69 | 2013 (previous service 1991 - 2007) | Mr. Gallagher is the Executive Chairman of Genuine Parts Company, a distributor of automotive replacement parts, industrial replacement parts, office products and electrical/electronic materials. He was appointed as Chairman of the Board of Genuine Parts Company in 2005 and served as Chief Executive Officer from 2004 until he retired from that position in 2016. Mr. Gallagher served as President of Genuine Parts Company from 1990 to 2012 and Chief Operating Officer of Genuine Parts Company from 1990 until 2004. Mr. Gallagher has more than 25 years of executive-level responsibilities with a NYSE-listed public company; brings extensive experience serving as a director of other companies, including having served on the board of directors of Genuine Parts Company for more than 25 years and having previously served on the boards of STI Classic Funds, STI Classic Variable Trust and National Services Industries, Inc.; and is extremely familiar with our company, having served on our Board for approximately 20 years. Mr. Gallagher's business acumen, financial expertise and leadership skills are a valuable asset to our Board and Audit Committee. | |||

Virginia A. Hepner | 59 | 2016 | Ms. Hepner is President and Chief Executive Officer of The Woodruff Arts Center, a visual and performing arts center, and has served in this position since 2012. Prior to joining The Woodruff Arts Center, she served as a consultant to DMI Music and Media Solutions from 2011 until 2012. She is also currently a principal investor in GHL, LLC, a private real estate investment partnership for commercial assets. Ms. Hepner retired from Wachovia Bank in 2005 as an Executive Vice President. Ms. Hepner serves as a director of State Bank and Trust Company, as well as its holding company State Bank Financial Corporation. Ms. Hepner previously served as a director of Chexar Corporation (now named Ingo Money, Inc.). Ms. Hepner's more than 25 years of corporate banking and capital markets experience, as well as her oversight of various aspects of The Woodruff Arts Center's operations, serves our Board well. | ||||

Name | Age | Director Since | Positions Held and Specific Experience and Qualifications | Age | Director Since | Positions Held and Specific Experience and Qualifications | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| John R. Holder | | 62 | 2009 | Mr. Holder is Chairman and Chief Executive Officer of Holder Properties, Inc., a commercial and residential real estate development, leasing and management company, and has held that position since 1989. Mr. Holder has served as Chief Executive Officer of Holder Properties since 1980. He is a member of the Board of Directors and Compensation, Nominating and Governance Committee of Genuine Parts Company and also serves on the Board of Directors of SunTrust Bank's Atlanta Region. Mr. Holder's strategic leadership in the growth of Holder Properties, as well as his extensive involvement in the financial and marketing areas of that business, serves our Board well. His service as the Chairman and Chief Executive Officer of Holder Properties, together with various board affiliations which has included civic organizations and membership on the Audit and Compensation, Nominating and Governance Committees of Genuine Parts Company, has given him leadership experience, business acumen and financial literacy beneficial to our Board and Audit Committee. | ||||||||||

| Dennis M. Love | 59 | 2008 | Mr. Love is Chairman and Chief Executive Officer of Printpack Inc., a manufacturer of flexible and specialty rigid packaging. Mr. Love was elected Chairman of Printpack Inc. in 2013, and has served as Chief Executive Officer of Printpack Inc. since 1987. Mr. Love also served as President of Printpack Inc. from 1987 until 2013. Mr. Love has been a director of AGL Resources, Inc. since 1999, currently serving as a member of its Audit and Nominating, Governance and Corporate Responsibility Committees. Mr. Love is also a director of the Cleveland Group, Inc. and a member of the SunTrust Advisory Board. Mr. Love has more than 25 years of experience as a chief executive and has extensive service as a director of public companies, including having served on the Compensation and Employee Benefits Committee of Caraustar Industries, Inc. and the Nominating, Governance and Corporate Responsibility Committee of AGL Resources, Inc. The insight Mr. Love gained through these board affiliations serves our Board and our Nominating, Compensation & Governance Committee well. In addition, Mr. Love's stewardship of Printpack Inc.'s international expansion, as well as successful domestic and international acquisitions, allows him to offer key insights into our operations and strategic decision making. | 61 | 2008 | Mr. Love retired as Chairman of Printpack Inc., a manufacturer of flexible and specialty rigid packaging, in January 2017, a position he held since 2005. Mr. Love also served as Chief Executive Officer of Printpack Inc. from 1987 until his retirement from that position during 2016. Mr. Love served as a director of AGL Resources, Inc. from 1999 until that company's merger with Southern Company in July 2016. Mr. Love is also a director of the Cleveland Group, Inc. and a member of the SunTrust Advisory Board. Mr. Love has close to 30 years of experience as a chief executive and has extensive service as a director of public companies, including having served on the Compensation and Employee Benefits Committee of Caraustar Industries, Inc. and the Nominating, Governance and Corporate Responsibility Committee of AGL Resources, Inc. The insight Mr. Love gained through these board affiliations serves our Board well. In addition, Mr. Love's stewardship of Printpack Inc.'s successful domestic and international acquisitions allows him to offer key insights into our operations and strategic decision making. | ||||||||

Clarence H. Smith | | 64 | 2003 | Mr. Smith is Chairman of the Board, President and Chief Executive Officer of Haverty Furniture Companies, Inc., a full-service home furnishings retailer. Mr. Smith was elected Chairman of Haverty Furniture Companies, Inc. in 2012 and has served as its President and Chief Executive Officer since 2003. He served as President and Chief Operating Officer of Haverty Furniture Companies, Inc. from 2002 to 2003, Chief Operating Officer of Haverty Furniture Companies, Inc. from 2000 to 2002, and Senior Vice President, General Manager-Stores of Haverty Furniture Companies, Inc. from 1996 to 2000. Mr. Smith serves on the Executive Committee of Haverty Furniture Companies, Inc. Mr. Smith has almost 20 years of senior management experience at Haverty Furniture Companies, Inc., an Atlanta-based, publicly traded company with over 100 stores in 16 states in the Southern, mid-Atlantic and Midwestern regions of the United States, which affords our Board and Nominating, Compensation & Governance Committee valuable insight into compensation, governance and general business practices at a company with a brand management focus and retail and other direct-to-consumer business activities. | | 66 | 2003 | Mr. Smith is Chairman of the Board, President and Chief Executive Officer of Haverty Furniture Companies, Inc., a full-service home furnishings retailer. Mr. Smith was elected Chairman of Haverty Furniture Companies, Inc. in 2012 and has served as its President and Chief Executive Officer since 2003. He served as President and Chief Operating Officer of Haverty Furniture Companies, Inc. from 2002 to 2003, Chief Operating Officer of Haverty Furniture Companies, Inc. from 2000 to 2002, and Senior Vice President, General Manager-Stores of Haverty Furniture Companies, Inc. from 1996 to 2000. Mr. Smith serves on the Executive Committee of Haverty Furniture Companies, Inc. Mr. Smith has over 20 years of senior management experience at Haverty Furniture Companies, Inc., an Atlanta-based, publicly traded company with over 120 stores in 16 states in the Southern and Midwest regions of the United States, which affords our Board and our Nominating, Compensation & Governance Committee valuable insight into compensation, governance and general business practices at a company with a brand management focus and retail and other direct-to-consumer business activities. | ||||||

Name | Age | Director Since | Positions Held and Specific Experience and Qualifications | ||||

|---|---|---|---|---|---|---|---|

| Clyde C. Tuggle | 53 | 2011 | Mr. Tuggle is Senior Vice President and Chief Public Affairs and Communications Officer of The Coca-Cola Company. From 1998 to 2000, Mr. Tuggle worked in Coca-Cola's Central European Division Office in Vienna where he held a variety of positions, including as Director of Operations Development, Deputy to the Division President and Region Manager for Austria. In 2000, Mr. Tuggle was elected Vice President of The Coca-Cola Company. In 2003, he was elected Senior Vice President of The Coca-Cola Company and appointed Director of Worldwide Public Affairs and Communications. From 2005 until 2008, Mr. Tuggle served as President of Coca-Cola's Russia, Ukraine & Belarus Business Unit. From 2008 to 2009, Mr. Tuggle served as Coca-Cola's Senior Vice President, Corporate Affairs and Productivity. In 2009, Mr. Tuggle was named Coca-Cola's Senior Vice President, Global Public Affairs and Communications. Mr. Tuggle has served on the Board of Directors of Georgia Power Company since 2012. Mr. Tuggle has more than 10 years of executive management experience at a publicly traded company heavily focused on brand management, including oversight of various aspects of Coca-Cola's international operations that serve our Board well. In addition, Mr. Tuggle's experience at Coca-Cola includes oversight of investor relations and public communications issues that provide key insights to our Board and Audit Committee. | ||||

Helen Ballard | | 60 | 1998 | Ms. Ballard founded Ballard Designs, Inc. in 1983 and served as Chief Executive Officer until she retired in 2002. Ballard Designs, Inc. is a home furnishing catalog business which is currently part of HSN, Inc. Ms. Ballard also previously served as a member of the Board of Directors of Cornerstone Brands, Inc., which was organized as a conglomerate of companies selling home and leisure goods and casual apparel through catalogs primarily aimed at affluent, well-educated consumers ages 35 to 60. Ms. Ballard has approximately 20 years of experience in a chief executive capacity. Ms. Ballard's experience in direct-to-consumer businesses, including a catalog business, in particular with business activities aimed at demographics overlapping those of our various operating groups, serves our Board well. | |||

Name | Age | Director Since | Positions Held and Specific Experience and Qualifications | ||||

|---|---|---|---|---|---|---|---|

| E. Jenner Wood III | 63 | 1995 | Mr. Wood was named Chairman, President and Chief Executive Officer of the Atlanta Division of SunTrust Bank in 2014 and has served as a Corporate Executive Vice President of SunTrust Banks, Inc. since 1994. Mr. Wood served as Chairman, President and Chief Executive Officer of the Atlanta/Georgia Division of SunTrust Bank from 2010 to 2013 and as Chairman, President and Chief Executive Officer of the Georgia/North Florida Division of SunTrust Bank from 2013 through March 2014. Prior to that, Mr. Wood had served as President, Chairman and Chief Executive Officer of SunTrust Bank Central Group from 2002 to 2010. Mr. Wood is a director of The Southern Company and Genuine Parts Company. Mr. Wood previously served as a director of Crawford & Company until his retirement from that position in July 2013. Mr. Wood also previously served as a director of Georgia Power Company until his election to the Board of Directors of that entity's parent company, The Southern Company, in 2012. Mr. Wood's professional career includes more than 20 years in executive management positions with SunTrust Banks, Inc. and its various affiliates. Mr. Wood's insights with respect to financial issues and the financial services industry generally, including as it relates to the retail and business aspects of SunTrust Bank's operations, together with his extensive experience on the boards of directors and committees of various public and private companies, make him a valuable asset to our Board. | ||||

Name | Age | Director Since | Positions Held and Specific Experience and Qualifications | ||||

|---|---|---|---|---|---|---|---|

Clyde C. Tuggle | 56 | 2011 | Mr. Tuggle is Senior Vice President, Global Public Affairs and Communications of The Coca-Cola Company and has served in that capacity since 2009. From 1997 to 2000, Mr. Tuggle worked in Coca-Cola's Central European Division Office in Vienna where he held a variety of positions, including as Director of Operations Development, Deputy to the Division President and Region Manager for Austria. In 2000, Mr. Tuggle was elected Vice President of The Coca-Cola Company. In 2003, he was elected Senior Vice President of The Coca-Cola Company, appointed Director of Worldwide Public Affairs and Communications and named to The Coca-Cola Company's Executive Committee. From 2005 until 2008, Mr. Tuggle served as President of Coca-Cola's Russia, Ukraine & Belarus Business Unit. From 2008 to 2009, Mr. Tuggle served as Coca-Cola's Senior Vice President, Corporate Affairs and Productivity. Mr. Tuggle has served on the Board of Directors of Georgia Power Company since 2012 and also currently serves on the board of directors of TRIFORM, LLC. Mr. Tuggle has more than 10 years of executive management experience at a publicly traded company heavily focused on brand management, which serves our Board well. In addition, Mr. Tuggle's experience at Coca-Cola includes oversight of investor relations and public communications issues that provide key insights to our Board and Audit Committee. | ||||

E. Jenner Wood III | | 65 | 1995 | Mr. Wood served as Corporate Executive Vice President of SunTrust Banks, Inc. from 1994 until his retirement in 2016. He also served as Chairman, President and Chief Executive Officer of the Atlanta Division of SunTrust Bank from 2014 to October 2015. Mr. Wood served as Chairman, President and Chief Executive Officer of the Atlanta/Georgia Division of SunTrust Bank from 2010 to 2013 and as Chairman, President and Chief Executive Officer of the Georgia/North Florida Division of SunTrust Bank from 2013 through March 2014. Prior to that, Mr. Wood had served as President, Chairman and Chief Executive Officer of SunTrust Bank Central Group from 2002 to 2010. Mr. Wood is a director of The Southern Company and Genuine Parts Company. Mr. Wood serves on the Governance and Nuclear/Operations Committees of The Southern Company and on the Audit and Compensation and Governance Committees of Genuine Parts Company. Mr. Wood previously served as a director of Crawford & Company until his retirement from that position in 2013. Mr. Wood also previously served as a director of Georgia Power Company until his election to the Board of Directors of that entity's parent company, The Southern Company, in 2012. Mr. Wood's professional career includes more than 20 years in executive management positions with SunTrust Banks, Inc. and its various affiliates. Mr. Wood's insights with respect to financial issues and the financial services industry generally, including as it relates to the retail and business aspects of SunTrust Bank's operations, together with his extensive experience on the boards of directors and committees of various public and private companies, make him a valuable asset to our Board. | |||

Our Corporate Governance Guidelines provide that we will have a majority of "independent" directors under the NYSE's listing standards, as determined by the Board, and that, at least annually, our Nominating, Compensation & Governance Committee or NC(or "NC&G Committee,Committee") will review each relationship that exists with a director and his or her related interests for the purpose of determining whether the director is independent. Based in part on our NC&G Committee's review, our Board annually considers the independence of each of our directors, as well as upon learning about intervening events that may impact director independence.

In March 2015,2017, our NC&G Committee and full Board considered director independence. As part of this consideration, our NC&G Committee and full Board broadly considered all relevant facts and circumstances, including the NYSE's corporate governance listing standards and all relevant transactions and relationships between each director (and his or her(including each director's immediate family members and other affiliates) and our company and management to determine whether any relationship might impair the director's ability to make independent judgments.

Based on this review and consistent with the recommendation of our NC&G Committee, our Board affirmatively determined that the following nine directors are independent: Helen Ballard; Thomas C. Gallagher; George C. Guynn;Virginia A. Hepner; John R. Holder; J. Reese Lanier; Dennis M. Love; Clarence H. Smith; Clyde C. Tuggle; Helen Ballard; and E. Jenner Wood III.

Mr. Chubb is currently our Chairman, Chief Executive Officer and President, and therefore not considered an independent director.

In evaluating the independence of our directors, our Board and NC&G Committee and Board gave particular consideration to the following relationships and transactions:

Our Board determined that these payments and relationships were not material to a determination that the applicable directors were independent. As a result and taking into consideration, among other things, the objectivity of Messrs. Gallagher, J. Reese Lanier, Tuggle and Wood at previous meetings of our Board, our Board determined that each is independent.

Mr. J. Hicks Lanier served as our Chief Executive Officer until his retirement at the end of 2012 and, accordingly, is not independent. Mr. Chubb is currently our Chief Executive Officer and President, and therefore not independent.

Corporate Governance Guidelines; Conduct Policies

Our Board has adopted Corporate Governance Guidelines that set forth certain guidelines for the operation of the Board and its committees. In accordance with its charter, our NC&G Committee periodically reviews and assesses the adequacy of our Corporate Governance Guidelines. As provided under our Corporate Governance Guidelines, our Board annually conducts a self-evaluation. Our NC&G Committee oversees our Board's self-evaluation process. Our Board has the authority to engage its own advisors and consultants.

Our Board has also adopted a Code of Conduct for all of our directors, officers and employees, as well as an ethical conduct policy that applies to our senior financial officers, including, among others, our chief executive officer and our chief financial officer and controller. We intend to disclose amendments to our Code of Conduct and our ethical conduct policy for our senior financial officers (other than technical, administrative or other non-substantive amendments) and material waivers of (or failure to enforce) any provisions of these conduct policies (if applicable to any of our directors or executive officers) on our Internet website at www.oxfordinc.com.

Board Meetings and Committees of our Board of Directors

During fiscal 2014,2016, our Board held foursix meetings and committees of our Board held a total of sevensix meetings. During fiscal 2014,2016, each of our directors attended 100%at least 75% of the aggregate number of meetings of our Board and of all committees of which the director was a member during the period he or she was a director or committee member.

Although we do not have a formal policy requiring attendance by directors at our annual meetings of shareholders, as stated in our Corporate Governance Guidelines, we encourage directors to attend our annual meetings of shareholders in person. In order to help facilitate attendance by our directors, we generally schedule our annual meetings of shareholders to coincide with the date of a quarterly meeting of our Board. AllNine of our directors attended our 2014 annual meeting2016 Annual Meeting of shareholders.Shareholders.

Our Board has a standing Executive Committee, Audit Committee and NC&G Committee. The following table identifies the members of each of these committees as of May 11, 2015April 13, 2017 and the number of official meetings held by each of these committees (and actions taken by written consent in lieu of meetings) held by each of these committees during fiscal 2014.2016.

Name | Executive Committee | Audit Committee | NC&G Committee | Executive Committee | Audit Committee | NC&G Committee | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Helen Ballard* | | | X | |||||||||

Thomas C. Chubb III | X | | | chair | ||||||||

Thomas C. Gallagher* | X | | X | | ||||||||

George C. Guynn* | | chair | | |||||||||

Virginia A. Hepner* | X | |||||||||||

John R. Holder* | X | | X | | ||||||||

J. Hicks Lanier | chair | | | |||||||||

J. Reese Lanier* | ||||||||||||

Dennis M. Love* | X | | X | X | chair | | ||||||

Clarence H. Smith* | X | chair | X | chair | ||||||||

Clyde C. Tuggle* | | X | | | X | | ||||||

Helen Ballard* | X | |||||||||||

E. Jenner Wood III* | X | | | X | ||||||||

| | | | | | | | | | | | | |

Total Number of Meetings | 0 | 5 | 2 | 0 | 4 | 2 | ||||||

Actions by Written Consent | 0 | 1 | 5 | 0 | 1 | 2 | ||||||

Executive Committee

Our Executive Committee has the power to exercise the authority of the full Board in managing the business and affairs of our company, except that our Executive Committee does not have certain powers that are reserved to our full Board under Georgia law. In practice, our Executive Committee serves as a means for taking action requiring our Board's approval between its regularly scheduled meetings.

Audit Committee

Our Audit Committee was established in accordance with the rules and regulations of the U.S. Securities and Exchange Commission (which we refer to as the "SEC") to assist our Board in fulfilling its responsibilities with respect to oversight of the following: (1) the integrity of our financial statements, reporting processes and systems of internal controls; (2) our compliance with applicable laws and regulations; (3) the qualifications and independence of our independent registered public accounting firm; and (4) the performance of our internal audit department and our independent registered public accounting firm.

The principal duties and responsibilities of our Audit Committee are set forth in its charter. Pursuant to its charter, our Audit Committee has full access to our books, records, facilities and personnel, as well as the express authority to retain, at our company's expense, any outside legal, accounting or other advisors that it deems necessary or helpful to the performance of its responsibilities. OurPursuant to its charter, our Audit Committee is also charged with reviewing our guidelines and policies with respect to risk assessment and risk management. In addition, our Audit Committee may exercise additional authority prescribed from time to time by our Board.

Our Board annually evaluates the financial expertise and independence of the members of our Audit Committee. Following its review in March 2015,2017, our Board determined that each of Mr. GuynnHolder and Mr. Holder is anLove are "audit committee financial expert,experts," as that term is defined by SEC rules and regulations, and that all of the members of our Audit Committee are financially literate in accordance with the NYSE's governance listing standards and SEC rules and regulations.

Nominating, Compensation & Governance Committee (or NC&G Committee)

The purpose of our NC&G Committee is to: (1) assist our Board in fulfilling its responsibilities with respect to the compensation of our executive officers; (2) recommend candidates for all directorships to be filled; (3) identify individuals qualified to serve as members of our Board; (4) review and recommend committee appointments; (5) take a leadership role in shaping our corporate governance; (6) develop and recommend our Corporate Governance Guidelines to our Board for adoption our Corporate Governance Guidelines;adoption; (7) lead our Board in an annual review of its own performance; and (8) perform other functions that it deems necessary or appropriate. Our Board has determined that all members of our NC&G Committee are independent in accordance with the NYSE's corporate governance listing standards. Pursuant to its charter, our NC&G Committee has the

express authority to retain or obtain the advice of a compensation consultant, independent legal counsel or other advisor, at our company's expense.

Our NC&G Committee also has the following responsibilities, among others, related to compensation matters: (1) administering our stock option and restricted stock plans; (2) administering our Executive Performance Incentive Plan, or "EPIP"; (3) reviewing and approving corporate goals and objectives relevant to the compensation of our Chief Executive Officer, evaluating our Chief Executive Officer's performance in light of those goals and objectives and determining the compensation of our Chief Executive Officer based upon this evaluation; (4) reviewing and approving the compensation of our non-CEO executive officers; and (5) making recommendations to our Board regarding certain incentive compensation plans and equity-based plans. In addition, as part of its oversight of our overall compensation program, our NC&G Committee considers our compensation policies and procedures, including the incentives that they create and factors that may influence excessive risk taking.

In light of NYSE rules, our Board evaluated the independence of the members of our NC&G Committee. Following its review in March 2015,2017, our Board determined that all of the members of our NC&G Committee are independent and meet the enhanced independence standards applicable to compensation committee members in accordance withunder the NYSE's corporate governance listing standards.

standards and SEC rules and regulations. For information about the role of executive officers and compensation consultants in determining compensation, see "Executive Compensation—Compensation Discussion and Analysis" below.

Meetings of Non-Employee Directors

Pursuant to our Corporate Governance Guidelines, our non-employee directors periodically meet separately in executive sessions. Mr. Wood, as our presiding independentlead director, chaired the meetings of our non-employee directors during fiscal 2014.2016.

Our Board is responsible for governing the affairs of our company effectively for the benefit of our shareholders. In discharging this responsibility, our Board relies on the judgment, business acumen, and experience of our qualified management team. Our directors believe that the appropriate leadership structure for our Board may change from time to time. As stated in our Corporate Governance Guidelines, our Board does not have a policy as to whether our Chief Executive Officer should also serve as chair of our Board. The Board makes this decision as it deems appropriate from time to time based upon the relevant factors applicable to each case. At least annually, the Board deliberates on and discusses the appropriate leadership structure for our Board based on the needs of our company.

Current Leadership Structure

Our Board is currently comprised of nine independent directors; one non-independent, non-management director (our retired Chief Executive Officer, Mr. J. Hicks Lanier);directors and one management director (our current Chairman, Chief Executive Officer and President, Mr. Chubb). Until his retirementWhen first electing Mr. Chubb as our Chief Executive Officer in December 2012, Mr. J. Hicks Lanier served in the dual capacity of Chief Executive Officer and chair of our Board. Based upon his insights into the day-to-day operations of our business and his long tenure on our Board and the continuity that his experience offered, we believed that our company and shareholders were best served by having Mr. Lanier serve in both capacities.

At the time of Mr. Lanier's retirement from his position as our Chief Executive Officer in December 2012, we separated the roles of chair of our Board (Mr. Lanier) and Chief Executive Officer (Mr. Chubb). At that time, our Board considered the myriad factors relevant to establishing an effective leadership structure. Based upon these considerations, including Mr. Lanier's distinct qualifications to provide advice to, and oversight of, management, our Board believed that Mr. Lanier's continued service as the chair of our Board was appropriate, with Mr. Chubb, in his capacity as our Chief Executive Officer, focusing on the daily operations of our business, the activities of our operating groups, our business objectives and other factors impacting our business.

We also have a presiding independent director (Mr. E. Jenner Wood III). In his capacity as the presiding independent director, Mr. Wood sets the agenda for, and chairs, executive sessions of our non-employee directors; serves as a liaison between independent directors and our Chairman and our Chief Executive Officer; and serves as a liaison between our shareholders and our independent directors. As presiding independent director, Mr. Wood is in regular contact with our

Chairman and our Chief Executive Officer about our operating results and activities, risks to our business and business prospects.

Our Board believes this structure has served us well since Mr. Lanier's retirement as Chief Executive Officer.

Change to Leadership Structure in June 2015,

Mr. Lanier is retiring from our Board at the conclusion of the 2015 annual meeting, as he has reached the retirement age set forth in our bylaws. In anticipation of Mr. Lanier's eventual retirement, our Board deliberated extensively over several months about the most appropriate leadership structure for the future. Our Board currently expects that Mr. Chubb, our Chief Executive Officer and President, will be elected to also serve as the chair of our Board following Mr. Lanier's retirement. Our Board also expects that Mr. Wood will continue in his role as our presiding independent director.

In making its decision, our Board considered Mr. Chubb's leadership qualities, management capability, knowledge of the business and industry, the long-term, strategic perspective he has demonstrated over the course of many years, his performance as our Chief Executive Officer and President and his demonstrated focus on growing long-term shareholder value. The Board

In Mr. E. Jenner Wood III, we also noted that we have in Mr. Wood, an active, engaged presidinglead (independent) director. In his capacity as the lead director, Mr. Wood sets the agenda for, and chairs, executive sessions of our non-employee directors; serves as a liaison between independent director.directors and Mr. Chubb; and serves as a liaison between our shareholders and our independent directors. As lead director, Mr. Wood is in regular contact with Mr. Chubb about our operating results and activities, risks to our business and business prospects.

We also have a supermajority of independent directors, regular meetings of our non-employee directors in executive session, and an Audit Committee and NC&G Committee (each of which reports to our full Board on a quarterly basis on significant committee activities) comprised solely of independent directors.

The Board recognizes that there is a variety of viewpoints concerning a board's optimal leadership structure, and considered all viewpoints in making its decision, including considerations around trends in board practices, statistical analyses on financial performance of companies with varying board leadership structures, the speed with which a combined Chair/CEO can identify company concerns and communicate this information to the other members of a board, and the ability of a combined Chair/CEO to provide superior information to the other members of a board given insights into the day-to-day issues faced by a company. Our Board also consideredbelieves the historical Board leadership structure at our company and the current composition of our Board, as well as our management team, business and performance.

Based on the extensive review and consideration by our Board, our Board believes a leadership structure comprised of an executive chair and CEO, balanced with a strong lead independent director role tasked with significant specified duties, is in the best interests of our company and shareholders as we move forward beyond the 2015 annual meeting.shareholders.

Board's Role in Risk Oversight

Our Board is ultimately charged with overseeing our business, including risks to our business, on behalf of our shareholders. In order to fulfill this responsibility, our Audit Committee, pursuant to its charter, reviews our policies with respect to our company's risk assessment and risk management. At our Audit Committee's direction and with its oversight, we conduct an enterprise risk management, or "ERM," program (which we refer to as the "ERM program") on an ongoing basis. At each quarterly meeting of our Audit Committee, a significant portion of time is devoted to a management report to the committee on the status of the ERM program and/or particular risks faced by our company. Our Audit Committee actively engages management on potential strategies for reducing, eliminating or mitigating the risks to our organization. Our Audit Committee regularly reports to our Board on our ERM program, and our management at least annually provides our Board with a full report on our ERM program.

In addition to our ERM program, our Board examines specific business risks in its regular reviews of our operating groups and also on a company-wide basis as part of its regular strategic reviews.

As part of its oversight of our overall compensation program, our NC&G Committee considers our compensation policies and procedures, including the incentives that they create and factors that may influence excessive risk taking. In particular, our compensation program provides for short-term cash incentive payments to individuals throughout our company based on satisfaction of pre-established performance targets. For employees within our various operating groups, these performance targets may be based on performance by the operating group, as a whole, or a specific business unit or business location within that operating group. Each cash incentive award for an individual employee within our organization is subject to a maximum amount payable to the individual. Our senior management and, with respect to our executive officers, our compensation committee,NC&G Committee, approve applicable performance targets taking into consideration our detailed, internal budgets for upcoming fiscal periods. These members of senior management have access to daily retail and e-commerce sales data and receive monthly financial reports, and they review and analyze deviations from the budgeted plans to assess whether, among other things, the deviations were the result of inappropriate risk taking. We have concluded that our compensation policies and procedures are not reasonably likely to have a material adverse effect on our company.

We have posted our Corporate Governance Guidelines, our Code of Conduct, our ethical conduct policy for our senior financial officers, our Audit Committee charter and our NC&G Committee charter under the "Corporate Governance" link under the "Investor Relations" tab on our Internet website at www.oxfordinc.com.

In accordance with our Corporate Governance Guidelines, our NC&G Committee periodically reviews the skills and characteristics required of our directors in the context of the make-up of our Board. This assessment includes issues such as independence, expertise, age, diversity, general business knowledge and experience, financial literacy, availability and commitment and other criteria that our NC&G Committee finds to be relevant.

Consistent with our Corporate Governance Guidelines, our NC&G Committee recognizes that a diversity of viewpoints and practical experiences can enhance our Board's effectiveness. Accordingly, it is the practice of our NC&G Committee in evaluating the diversity of potential director candidates to give particular consideration to the diverse experiences and perspectives that a prospective candidate may bring to our Board. In order to accomplish its objectives, our NC&G Committee's evaluations of potential candidates generally involve a review of the candidate's background and credentials, interviews of a candidate by members of our Board, and discussions among our directors. Based on its evaluation in light of the foregoing factors, our NC&G Committee recommends candidates to our full Board which, in turn, selects candidates to be nominated for election by the shareholders or to be elected by our Board to fill a vacancy.

Compensation Program for Fiscal 20142016

During fiscal 2014,2016, our non-employee directors received compensation in accordance with the following program guidelines:

To further encourage our directors to enhance their ownership of our stock, our non-employee directors are given the option to elect to receive the $30,000their annual cash retainerretainers in the form of a one-time restricted stock grant having a grant date fair value of $30,000.equal to the retainer. For fiscal 2014,2016, two of our non-employee directors elected to receive the $30,000 annualtheir cash retainerretainers in the form of restricted stock.

Director compensation is paid for the 12-month period commencing with each annual meeting of shareholders. The number of shares of our restricted stock to be issued in respect of each non-employee director's annual stock retainer (and in respect of the annual cash retainer, if a director elected to receive that portion of his retainer in the form of stock) was based on the closing price of our common stock as reported on the NYSE as of the grant date for the restricted stock.

Under our deferred compensation plan,Deferred Compensation Plan, our non-employee directors are eligible to defer receipt of up to 100% of their cash retainers and/or board and committee meeting fees. Non-employee directors are permitted to "invest" their deferred fees among a platform of investment options that are available to our eligible employees who participate in the plan. Our deferred compensation planDeferred Compensation Plan is an unfunded, non-qualified deferred compensation plan, and participants' account balances are subject to the claims of our company's creditors. In the event that our company becomes insolvent, participants in the plan would be unsecured general creditors with respect to their account balances, which we believe further aligns the interests of our participating directors with the long-term interests of our shareholders. TwoThree of our non-employee directors participated in our deferred compensation planDeferred Compensation Plan during fiscal 2014.2016.

Employee directors do not receive an annual retainer or meeting fees for their service on our Board.

Director Compensation for Fiscal 20142016

The table below summarizes the compensation for our non-employee directors for fiscal 2014.2016.

Name | Fees Earned or Paid in Cash($) | Stock Awards ($)(1) | All Other Compensation ($)(2) | Total ($) | Fees Earned or Paid in Cash($) | Stock Awards ($)(1) | All Other Compensation ($)(2) | Total ($) | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Helen Ballard | | 40,039 | | 59,961 | | 1,027 | | 101,027 | ||||||||||||||||||

Thomas C. Gallagher | | 41,314 | | 49,936 | | 623 | | 91,873 | 42,539 | 59,961 | 1,027 | 103,527 | ||||||||||||||

George C. Guynn | 53,814 | 49,936 | 623 | 104,373 | ||||||||||||||||||||||

George C. Guynn(3) | | 18,125 | | — | | 170 | | 18,295 | ||||||||||||||||||

Virginia Hepner | 27,539 | 59,961 | 858 | 88,358 | ||||||||||||||||||||||

John R. Holder | | 11,313 | | 79,937 | | 861 | | 92,111 | | 12,531 | | 89,969 | | 1,372 | | 103,872 | ||||||||||

J. Hicks Lanier | 37,564 | 49,936 | 623 | 88,123 | ||||||||||||||||||||||

J. Reese Lanier | | 35,064 | | 49,936 | | 623 | | 85,623 | 37,539 | 59,961 | 1,027 | 98,527 | ||||||||||||||

Dennis M. Love | 7,563 | 79,937 | 861 | 88,361 | | 12,518 | | 102,482 | | 1,507 | | 116,507 | ||||||||||||||

Clarence H. Smith | | 49,439 | | 49,936 | | 623 | | 99,998 | 52,539 | 59,961 | 1,027 | 113,527 | ||||||||||||||

Clyde C. Tuggle | 41,314 | 49,936 | 623 | 91,873 | | 42,539 | | 59,961 | | 1,027 | | 103,527 | ||||||||||||||

Helen Ballard | | 37,564 | | 49,936 | | 623 | | 88,123 | ||||||||||||||||||

E. Jenner Wood III | 35,064 | 49,936 | 623 | 85,623 | 38,789 | 59,961 | 1,027 | 99,777 | ||||||||||||||||||

Stock Ownership and Retention Guidelines

To reinforce the alignment of the interests of our directors with the long-term interests of our shareholders, our Board has established stock ownership guidelines applicable to our non-employee directors. Under these guidelines, each of our non-employee directors is expected to accumulate and hold shares of our common stock having a fair market value equal to 2.0x the director's annual retainer. Our non-employee directors have four years from their appointment to meet their ownership guideline requirement. Each of our non-employee directors has met, or is on track to meet, his/her ownership guideline.

In addition, our Corporate Governance Guidelines provide for a retention guideline, or holding period, of one year for stock acquired upon the exercise of options or lapse of restrictions on restricted stock (net of funds reasonably expected to be necessary to satisfy applicable taxes and/or pay the exercise price of stock options) that applies to our non-employee directors.

All of our executive officers are elected by and serve at the discretion of our Board. The following table sets forth information about our executive officers as of April 17, 2015:13, 2017:

Name | Age | Title | Biography | |||

|---|---|---|---|---|---|---|

| Thomas C. Chubb III | Chairman, Chief Executive Officer and President | Mr. Chubb is our Chairman, Chief Executive Officer and President. He has | ||||

Thomas E. Campbell | Executive Vice | Mr. Campbell is Executive Vice President-Law and Administration, General Counsel and Secretary and has held that position since 2014. Prior to his promotion in 2014, Mr. Campbell served as our Senior Vice President-Law and Administration, General Counsel and Secretary from 2011 to | ||||

K. Scott Grassmyer | Executive Vice | Mr. Grassmyer is Executive Vice President-Finance, Chief Financial Officer and Controller and has served in this capacity since 2014. Prior to his promotion in 2014, Mr. Grassmyer served as our Senior Vice President-Finance, Chief Financial Officer and Controller from 2011 to | ||||

J. Wesley Howard, Jr. | President, Lanier | Mr. Howard is President, Lanier | ||||

Mr. |

In this section of the proxy statement, we provide information about our executive compensation program specifically as it relates to our "named executive officers," or NEOs. This information includes: (1) a Compensation Discussion and Analysis discussing, among other things, how and why our NC&G Committee (which we refer to in this section of the proxy statement as our "compensation committee") made its fiscal 20142016 compensation decisions for our NEOs; (2) the compensation tables required by the SEC's rules and regulations; and (3) a summary of certain limited arrangements with our NEOs that provide for payments upon defined change of control events or upon termination of employment.

For fiscal 2014,2016, our NEOs arewere as follows:

Because Ms. Kelly and Mr. Wood first became NEOs in fiscal 2016, in accordance with SEC rules and regulations, we have not included compensation information for them for fiscal 2014 and fiscal 2015.

Compensation Discussion and Analysis

Executive Summary

We are a global apparel company that designs, sources, markets and distributes products bearing the trademarks of our company-owned lifestyle brands, as well as certain licensed and private label apparel products. Our portfolio of owned brands includes Tommy Bahama®, Lilly Pulitzer® and Ben Sherman®. We distribute our company-ownedSouthern Tide® lifestyle branded products through our direct to consumer channel, consisting of our retail storesbrands, other owned brands and e-commerce sites and Tommy Bahama restaurants in select locations, and our wholesale distribution channel, which includes better department stores and specialty stores.licensed brands as well as private label apparel products. During fiscal 2014, 90%2016, 92% of our net sales were from products bearing brands that we own and 61%66% of our net sales were sales of our products through our direct to consumer channels of distribution. In fiscal 2016, 96% of our consolidated net sales were to customers located in the United States, with the sales outside the United States consisting primarily of our Tommy Bahama products in Canada and the Asia-Pacific region.

Our business strategy is to develop and market compelling lifestyle brands and products that evoke a strong emotional response from our target consumers. We consider "lifestyle"lifestyle brands to be those brands that have a clearly defined and targeted point of view inspired by an appealing lifestyle or attitude, such as theattitude. Furthermore, we believe lifestyle brands like Tommy Bahama, Lilly Pulitzer and Ben Sherman brands. In executing our objectives, we striveSouthern Tide that create an emotional connection with consumers can command greater loyalty and higher price points at retail and create licensing opportunities, which may drive higher earnings. We believe the attraction of a lifestyle brand depends on creating compelling product, effectively communicating the respective lifestyle brand message and distributing products to develop businesses that can drive sustained profitable growthconsumers where and enhance long-term shareholder value.when they want it.

Fiscal 2014Overall, fiscal 2016 was another gooda relatively challenging year for us, withvarious aspects of our company, affected by a mid-single digits percentageretail climate that saw significant declines in consumer traffic in traditional brick-and-mortar retail locations. We believe that the compensation paid to our NEOs in respect of fiscal 2016 properly gave effect to the results of our operations. Highlights from our fiscal 2016 performance include:

For our shareholders, we achieved a total shareholder return over the last three years of 18%. While our stock price at the end of fiscal 2014 was less than it was at the end of fiscal 2013, we have started 2015 well. Our stock price has risen 40%

during

Our focus remains on delivering long-term shareholder value, and we believe that each of our key lifestyle brands has competitive advantages that will enable it to thrive in the new retailing paradigm and contribute to meaningful growth in our business.

Consideration of Last Year's Advisory Shareholder Vote on NEO Compensation

At our 20142016 annual meeting, of shareholders, we held an advisory vote seeking shareholder approval of a "say-on-pay" proposal approving our NEO compensation program. At the 20142016 annual meeting, approximately 99%95% of the votes cast on our say-on-pay proposal were cast in support of our NEO compensation program, as described in our 20142016 proxy statement. In light ofRecognizing the extraordinary shareholder support on last year's say-on-pay proposal, our compensation committee has continued to apply the same principles and general compensation programs for fiscal 2014.2016. However, our compensation committee regularly evaluates market compensation practices, taking into consideration information relating to compensation paid by peers, and information furnished by management and compensation consultants, and implements changes as it deems appropriate.

Compensation Philosophy and Objectives

Our executive compensation programs are designed to:

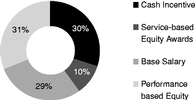

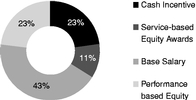

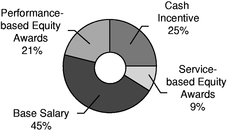

Consistent with these objectives, our NEO compensation practices incorporate the following in consideration of the long-term best interests of our shareholders:

Compensation Decision Process

Compensation Committee; Compensation Consultants. Pursuant to its charter, our compensation committee has the authority, with our company's funding, to retain or obtain the advice of a compensation consultant to assist in the evaluation

of, among other things, chief executive officer and non-CEO executive officer compensation, provided, that it will retain such an advisor only after taking into consideration relevant factors relating to the advisor's independence from our management.

During fiscal 2014, ourOur compensation committee again retained Mercer (US) Inc. ("Mercer") as its compensation consultant during fiscal 2016 to assist with various executive compensation matters, including proposals for the total compensation paid to our executive officers, and the individual components of executive officer compensation, and market data, including the peer group, used by management in reviewing executive officer compensation and influencing our Chief Executive Officer's recommendations to the compensation committee on compensation paid to our other NEOs for fiscal 2014.2016.

In relation to our compensation committee's retention of Mercer, (US) Inc., our compensation committee considered various factors relating to the advisor's independence from our management, including those enumerated by the NYSE. As part of its evaluation, our compensation committee considered the following: Mercer's parent company Marsh & McLennan provides certain insurance brokerage services to our company; the fees paid to Mercer's parent companyMarsh & McLennan in connection with those brokerage services represented a nominal amount of the revenues generated by that entity;company; Mercer's policies and procedures relating to conflicts of interest; the fact that the Mercer consultants that work with our company do not presently own any of our common stock; and certain present and historic business relationships between Mercer or its affiliates, on the one hand, and employers of certain of our compensation committee members. Following its review, our compensation committee concluded that Mercer was independent and that the engagement of Mercer did not raise a conflict of interest.

In addition, during fiscal 2013, our company's management retained Towers Watson to evaluate the short-term cash incentive programs throughout our company. Although the engagement was not focused on or specific to executive compensation, certain observations and recommendations by Towers Watson influenced certain management recommendations to, and decisions by, our compensation committee in respect of fiscal 2014.

Table of Contentsindependent.

Key Participant Roles. The following table summarizes the significant roles of the various key participants, including those of certain of our executive officers, in the decision-making process with respect to NEO compensation, in particular for fiscal 2014:2016:

Participant | Roles | |

|---|---|---|

| Board of Directors | • Reviews and approves changes in equity and cash incentive plans available to our NEOs (other than those generally available to employees of our company on a non-discriminatory basis), including submission of plans to our shareholders for approval as may be required • Appoints the members of our compensation committee | |